According to data from HMRC more than 70 of savers who opened an ISA in the 20192020 tax year opted for a Cash ISA despite the dismal returns available. Any parents taking out a Junior Isa should be aware that the child can take control of the account when they turn 16 and then start withdrawing money from the age of 18.

Tax rules for ISA accounts can change and their benefits depend on your circumstances.

Should i open an investment isa?. It is the latest member of the Isa family joining cash Isas stocks and shares Isas Junior Isas Help to Buy Isas and innovative finance Isas in an increasingly complex landscape for savers. You open the stocks and shares isa first put the money in there then invest that money. You can buy and sell having cash in the stocks and shares isa at any time.

You can only open and pay into one stocks shares ISA per tax year. Investment ISA share dealing ISA and trading ISA are just other names for a stocks and shares ISA. Introduced in 1999 the Individual Savings Account or ISA is a hugely popular form of tax-free savings in the UK.

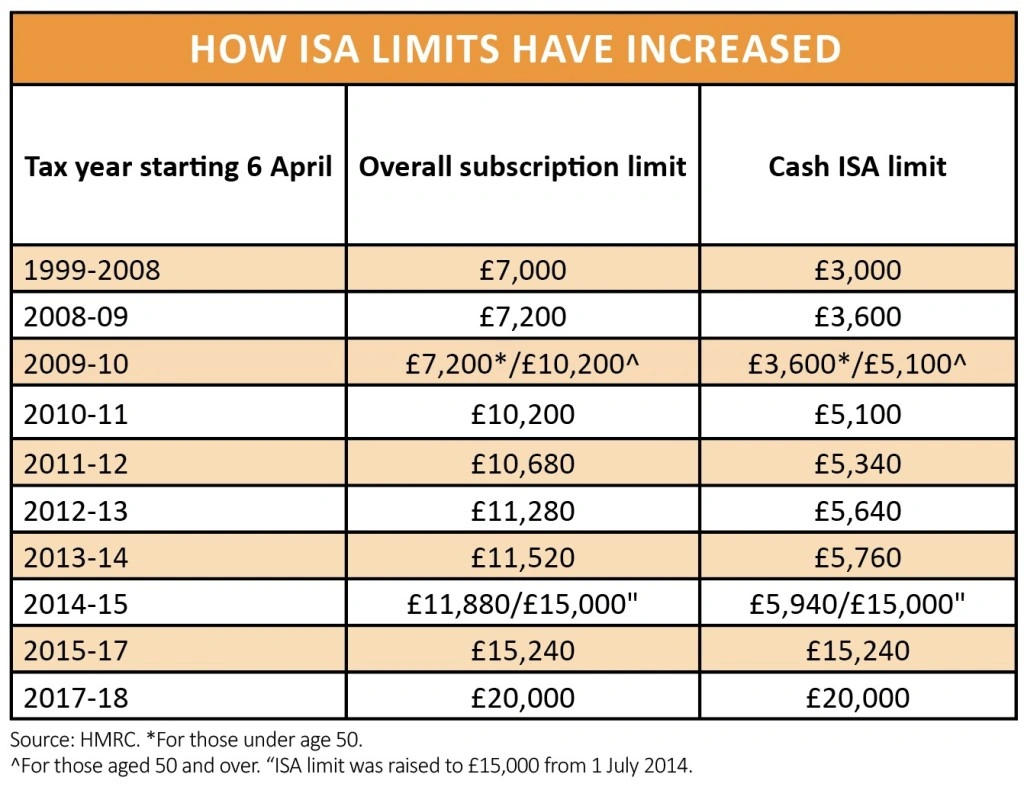

The government sets the Individual Savings Account limits each tax year. If you invest your money in an ISA you wont need to pay a thing in capital gains or dividend tax. You can invest in a junior ISA with fees as low as 037 assuming you invest in a global tracker fund for 012 per year and have a platform fee of 025.

Any kind of investment ISA should usually be considered with a long-term investment view in mind of at least three to five years. And the reason youll also hear that one-upped to tax wrapper is because when you put your investments in an ISA you dont have to pay tax on any growth your investments achieve. Crucially any unused allowance 20000 for 202122 doesnt roll over so if you dont use it you lose it forever.

The lifetime Isa LISA is a tax-free savings or investments account designed to help those aged 18-39 at the time of opening to buy their first home or save for retirement. ISAs are personal individual accounts and. Resident in the UK.

For the current tax year the limit is 20000. Parents or legal guardians can open a junior stocks and shares ISA on their childrens behalf. Aged 18 or over for a stocks and shares ISA.

In practice this means that you can contribute up to the maximum ISA allowance currently 20000 and any growth returns or interest you earn are tax-free. The money you pay into an ISA will already have had income tax deducted so no further tax will. To help buy a first home worth up to 450000 at any time from 12 months after you.

However before buying any shares I think there are some important first steps to consider. But you can open an investment Isa before the deadline and then either phase payments in slowly over the coming months or let the money sit in a cash park until you are ready to invest. You must invest in your stocks shares ISA by 5 April the end of the tax year for it to count for that year.

Indeed the best easy access Cash ISA. Some people invest via lump-sum contributions while others prefer to drip-feed money into the account on a regular basis. However any savings in your LISA can only be withdrawn without penalty in the following circumstances.

You dont have to use an ISA but you should. I think that opening up a Stocks and Shares ISA is the best way to start investing. Aged over 18 but under 40 for a Lifetime ISA.

An ISA acts as a tax-proofing wrapper for UK tax payers. You can also only open one stocks and shares ISA with one provider each year. A Stock and Shares and Help to Buy ISA you CANNOT invest in more than one of the same type of ISA.

It is very important to note that while you can have multiple different types of ISAs eg. You can open a stocks and shares ISA at any point during the tax year and you will not come under any pressure to invest the cash straight away. Your money is not locked away but its not so easily accessible as if you had put it in a cash savings account because you will need to.

An ISA is basically just an account that doesnt have to pay tax. This means if you have more than one ISA you can only invest up to 20000 between all of them. If you see a better deal during the next tax year such a lower investment fees you can open a new stocks shares ISA and transfer your funds over.

A LISA can be opened by a UK resident between the age 18 and 40 and any savings made before age 50 will attract a government bonus of 25 so 1000 if you make the maximum 4000 contribution. Their tax advantages and flexibility mean that for medium-to-long-term saving and investing they are a vehicle almost everyone should consider. An ISA or Individual Savings Account is a tax-efficient way of investing your money.

If you find another company whose fees are lower or whose platform just suits you better you can either transfer your current ISA. All four investment accounts offer a tax-efficient home for your investments. To open an ISA account you must be.

The simple answer is yes. Making the most of the tax benefits available to you is crucial for maximising your returns over the long-term. Investors can use ISAs to hold savings in the form of cash shares or collective investments such as unit trusts or other funds.

Can I invest for my children. This is how Id. The ISA allowance is an individual one which.

Aged 16 or over for a cash ISA. Individual Savings Accounts ISAs form the bedrock of most serious UK investors portfolios and rightly so. So if you already have contributed money into another Stock and Shares ISA this tax year you would not be able to open.

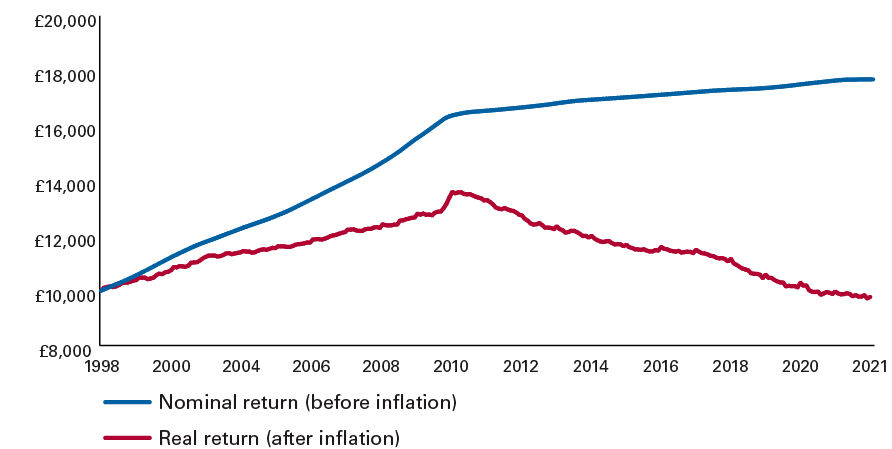

Why You Should Invest In A Stocks And Shares Isa Rather Than A Cash Isa Vanguard Uk Investor

Why You Should Invest In A Stocks And Shares Isa Rather Than A Cash Isa Vanguard Uk Investor

Homepage Money To The Masses Investing Debt Management Money

Homepage Money To The Masses Investing Debt Management Money