But the flipside is that your investment has the potential to perform better than a cash deposit. But you can only pay into one stocks and shares ISA during each tax year.

Choosing The Best Funds For Your Stocks And Shares Isa

Choosing The Best Funds For Your Stocks And Shares Isa

Comfortable choosing your own investments in an ISA.

Should i open a stocks and shares isa?. You can only subscribe to one Stocks and Shares ISA per tax year. You can only open one stocks and shares ISA in each tax year. You can only pay into one each tax year but can open a new one with a different platform each year if you want.

If youre a UK tax resident and over 16 for cash ISAs and 18 for stocks and shares you may be able to open an ISA. Can I invest for my children. They are also likely to ask for ID and proof of address.

A stocks shares ISA should be seen as a medium to long-term investment. Should I open a Stock and Shares ISA now or wait given the current environment. It is also advisable that you leave your money in the account for the medium to long term meaning at least five years.

Some people invest via lump-sum contributions while others prefer to drip-feed money into the account on a regular basis. Its important to know that stocks shares ISAs can go up or down in value so you might not get back what you originally invested. Investing could be right for you so consider a stocks shares ISA.

Investing is for the long term so a cash ISA would be best. You can only open and pay into one stocks shares ISA per tax year. If you have more than one stocks and shares ISA open you are only allowed to.

Therefore it makes sense to use as much of your allowance as. Another good reason to open a Stocks and Shares ISA in 2020 is the fact that the ISA allowance is a use it or lose it allowance. On the flip side a Stocks and Shares ISA has far better growth potential than a Cash ISA.

A cash ISA may seem the safest option but the rising cost of. When opening a Stocks and Shares ISA a separate Share Dealing Account will automatically be opened for you. Stocks and shares ISA Then Id open up a Stocks and Shares ISA.

A Stocks and Shares ISA - also known as an Investment ISA - is a tax-free wrapper for your savings which enable you to earn returns on your investments which are safe from the tax man. Learn more about ISA rules. You can open a stocks and shares ISA at any point during the tax year.

Parents or legal guardians can open a Junior ISA for children. Happy to risk losing money but need access sooner. The ISA provider will require your address nationality date of birth phone number and national insurance number.

The rules for stocks and shares ISAs are the same as as with any ISA. Not happy to risk losing money. You can open a Stocks and Shares ISA if youre over the age of 18 and UK resident for tax purposes.

Can I transfer an existing stocks and shares Isa. Parents or legal guardians can open a junior stocks and shares ISA on their childrens behalf. You open the stocks and shares isa first put the money in there then invest that money.

Your tax allowance for 20202021 is 20000 and the deadline is 5 months away so if youve not squirrelled away some cash into an ISA then now is the time for this tax year. The idea was to leave the money in the. Hi Just before COVID-19 I was in the process of opening up a stock and shares ISA with Hargreaves Lansdown.

Once you open an account most providers advise you should be prepared to invest for at least five years. Yes you can open a new stocks and shares ISA with a different provider every year if you wish. You could save 11000 in a cash ISA 2000 in a stocks and shares ISA 3000 in an innovative finance ISA and 4000 in a Lifetime ISA in one tax year.

An ISA is basically just an account that doesnt have to pay tax. I was going to put an initial 1000 in and contribute 50 a month and select an automated fund with a moderate risk level. So if youve already made a stocks and shares ISA subscription for the 201718 tax year you can only top up that ISA.

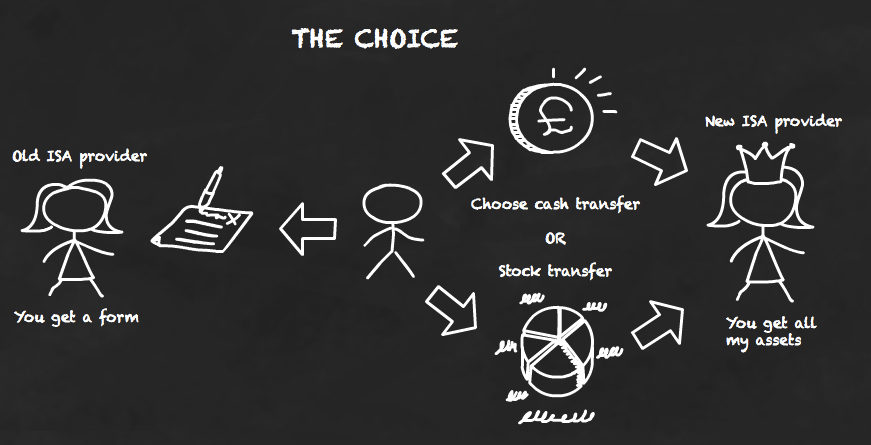

Yes although you should look out for transfer out fees from your current provider. You can open a stocks and shares ISA at any point during the tax year and you will not come under any pressure to invest the cash straight away. Understanding a Stocks and Shares ISA.

You should also be. You can pay into one stocks and shares ISA account in each tax year so if you opened one already you wouldnt be able to open one until the new tax year starts. Halifax Stocks and Shares ISAs are not flexible ISAs so money you withdraw then pay back in during the same tax year will count towards your 20000 ISA allowance.

You dont have to use an ISA but you should. If you decide that another provider suits your needs you can transfer previous years investments into the one account making it easier to monitor and administer your investments. Stocks and shares are more risky than cash as the value of your investment can go down as well as up.

The longer you leave your money in a stock and shares ISA the better your chances of riding out the ups and downs of the stock market and seeing your money grow. Investing in a stocks and shares ISA means taking some risk with your cash in the expectation that it will grow faster. If you see a better deal during the next tax year such a lower investment fees you can open a new stocks shares ISA and transfer your funds over.

There are different eligibility requirements for certain types of ISA. Your ISAs will not close when the tax. You can buy and sell having cash in the stocks and shares isa at any time.

You can however transfer your existing stocks and shares ISA over from a different ISA provider. And with a stocks and shares LISA you have the opportunity to invest in stock market assets rather than in a cash saving scheme. Its huge advantage is that theres no income tax due on the dividends or capital gains tax on profits.

If you can put some of your money away for at least five years you could split it between a cash and a stocks shares ISA.

How Many Stocks And Shares Isas Am I Allowed

How Many Stocks And Shares Isas Am I Allowed

How To Transfer A Stocks And Shares Isa Monevator

How To Transfer A Stocks And Shares Isa Monevator